When it comes to credit, three major credit reporting bureaus dominate the scene in the United States: Equifax, Experian, and TransUnion. These organizations collect and maintain credit information, generating credit reports and scores that play a pivotal role in lending decisions. If you’ve ever applied for a loan, credit card, or mortgage, chances are your creditworthiness was evaluated based on data from one—or all—of these bureaus. Let’s break down what each bureau does, how their scoring system works, and what those scores mean for you.

The Three Major Credit Reporting Bureaus

1. Equifax

- Headquarters: Atlanta, Georgia

- Role: Equifax compiles your credit data from lenders, banks, and other financial institutions to generate credit reports and scores. They also offer credit monitoring services to consumers.

- Contact Info:

- Website: www.equifax.com

- Phone: 1-888-548-7878

2. Experian

- Headquarters: Dublin, Ireland (North American HQ in Costa Mesa, California)

- Role: Experian is known for its detailed credit reports and innovative credit products, including its Boost program, which allows consumers to add utility and phone payments to their credit history.

- Contact Info:

- Website: www.experian.com

- Phone: 1-888-397-3742

3. TransUnion

- Headquarters: Chicago, Illinois

- Role: TransUnion collects and updates credit information from various sources, focusing on accuracy and fraud protection. They also offer consumer tools to help monitor credit health.

- Contact Info:

- Website: www.transunion.com

- Phone: 1-800-916-8800

How the Credit Scoring System Works

Credit Scores: A Snapshot of Risk

The credit bureaus generate scores based on data in your credit report, assessing how likely you are to repay borrowed money. The most commonly used scoring model is FICO® (Fair Isaac Corporation), although VantageScore has gained traction in recent years.

Score Range and Interpretation

Credit scores typically range from 300 to 850, with higher scores indicating lower credit risk. Here’s how they break down:

- 300–579: Poor

Lenders view scores in this range as high risk, making it challenging to secure loans or credit cards. If approved, expect higher interest rates and limited terms. - 580–669: Fair

This is a subprime category. Borrowers may qualify for credit but often at higher costs. - 670–739: Good

Considered a reliable range by most lenders. Borrowers are likely to receive favorable rates and terms. - 740–799: Very Good

Scores in this range open the door to better interest rates and financial opportunities. - 800–850: Excellent

Borrowers with these scores enjoy the best rates, loan terms, and credit offers.

Which Bureau is Predominant?

Interestingly, there’s no single bureau that dominates across all industries. Lenders choose which bureau to use based on their own preferences and the type of credit being offered. For example:

- Equifax: Often used by mortgage lenders.

- Experian: Common for auto loans and personal loans.

- TransUnion: Frequently used by credit card issuers.

In practice, lenders may pull reports from multiple bureaus to get a comprehensive view of your creditworthiness.

How the Scores Are Calculated

Key Factors in Credit Scoring

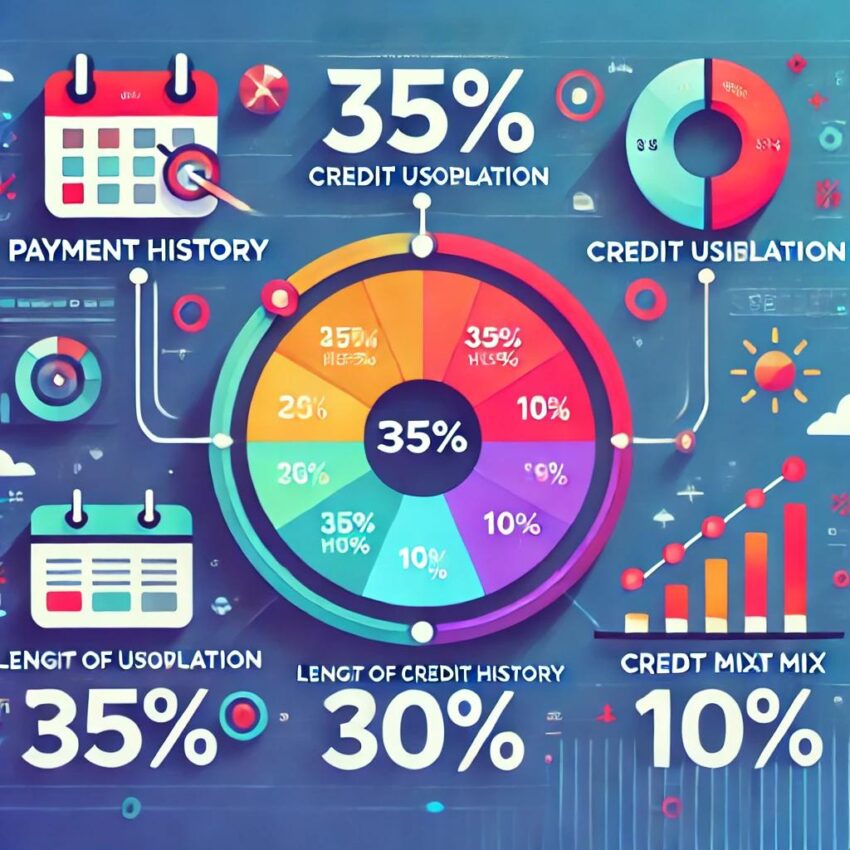

Though each scoring model has its nuances, the core factors influencing your score remain consistent:

- Payment History (35%): Late payments, missed payments, or accounts in collections negatively impact your score.

- Credit Utilization (30%): The percentage of available credit you’re using; lower utilization typically boosts scores.

- Length of Credit History (15%): Longer credit histories generally work in your favor.

- Credit Mix (10%): Having a variety of credit accounts (e.g., credit cards, mortgages, loans) can help.

- New Credit (10%): Multiple hard inquiries or recently opened accounts can lower your score temporarily.

How Credit Scores Are Used

Lenders rely on credit scores to make quick decisions about loan approvals, interest rates, and credit limits. Beyond borrowing, your score can also influence:

- Housing: Landlords may check your credit when you apply to rent.

- Insurance: Some insurers use credit-based scores to set premiums.

- Employment: Certain employers check credit reports during the hiring process.

In short, your credit score acts as a financial fingerprint, shaping opportunities in various aspects of life.

How to Contact the Credit Bureaus

If you need to dispute errors, monitor your credit, or request a report, here’s how to reach each bureau:

- Equifax

- Mail: P.O. Box 740256, Atlanta, GA 30374

- Website: www.equifax.com

- Experian

- Mail: P.O. Box 4500, Allen, TX 75013

- Website: www.experian.com

- TransUnion

- Mail: P.O. Box 2000, Chester, PA 19016

- Website: www.transunion.com

Your credit score plays a critical role in financial health, affecting everything from interest rates to job prospects. Understanding how the three major bureaus operate and what goes into your score empowers you to take control of your credit. Regularly monitoring your credit reports, maintaining low debt levels, and ensuring timely payments can keep you in good standing—and open doors to better financial opportunities.